NEW DELHI: Consumers should brace for a more than 15% rise in cost of making calls over mobile phones as some operators consider increasing rates, albeit gradually, to boost profitability and increase their cash flows.

"All we want is 10 paise (per minute) more from customers," said a top executive at one of India's largest mobile phone operators. "And that too, over a period of time, not at one go. I am sure they (customers) won't mind."

The extra 10 paise is all that most top mobile phone operators would need to boost profitability, and generate enough cash to fund capital expenditure plans which would be the bedrock of their future growth, this person told ET.

The comments echoed the general mood in the industry which has just emerged from a quarter that reflected easing competition and the return of pricing power.

Industry leaders also hope that new merger & acquisition guidelines, expected in a couple of months, could facilitate consolidation. About three to four fewer operators in the market would thus help sustain the pricing stability.

Call rates in India hit rock bottom amid intense competition since late 2008, denting companies' financials.

However, the Supreme Court's decision to cancel over 122 telecom licences early last year came as a blessing for unaffected operators, mainly the bigger ones with licences to offer services across the country, as competition eased.

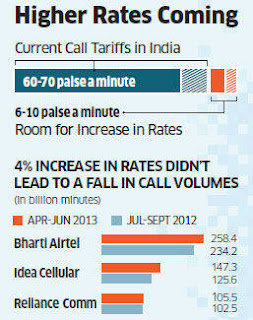

Players such as Bharti Airtel, Idea Cellular and Reliance Communications raised call rates - by an average about 4% in the April-June quarter - which helped grow their revenue per minute (RPM) and average revenue per user (ARPU), said analysts. The companies added that there was room to further raise rates, but didn't say by how much. Despite the increases, call tariffs in India are still among the lowest in the world at about 60-70 paise a minute, which could go up to 70-80 paise if the executive's wish is accepted. "As we go forward, you will see some more hardening in the coming months," Gurdeep Singh, president & chief executive (wireless business) at Reliance Communications, told ET recently.

The industry "needs and can afford" to raise call tariffs by 6-10 paise, brokerage Kotak said in a report. "We also believe that this would happen in a few steps and may not be a sustained gradual increase; it would of course be a calibrated one over the next 1-2 years."

Still, while all operators are convinced about the need for an increase, the quantum is still up for debate. Sigve Brekke, head of Norwegian telecom major Telenor ASA's Asian operations, said a 10-paise "hike is good but only for big operators".

"Our target customers cannot afford such a hike, and we feel there is still a lot of growth left in this country which can be targeted through the classic low-tariff, high-volume model," he said. Uninor, Telenor's India unit, offers services in six of India's 22 service areas.

Analysts say that while Uninor needs to add subscribers aggressively, and hence can't afford to raise rates too much, the bigger players have already attained strong mobile penetration.

The big operators do have a case, they add.

An analyst at a Mumbai-based foreign brokerage said each 1 paisa increase in call rates translates into a 6.5-10% growth in net profit, depending on the size of the operator. "The smaller the operator, bigger the benefit." He added that Bharti Airtel would be towards the lower end of the range as its consolidated net profit includes its stressed Africa operations, while Idea and Reliance Communications would benefit more.

"All we want is 10 paise (per minute) more from customers," said a top executive at one of India's largest mobile phone operators. "And that too, over a period of time, not at one go. I am sure they (customers) won't mind."

The extra 10 paise is all that most top mobile phone operators would need to boost profitability, and generate enough cash to fund capital expenditure plans which would be the bedrock of their future growth, this person told ET.

The comments echoed the general mood in the industry which has just emerged from a quarter that reflected easing competition and the return of pricing power.

Industry leaders also hope that new merger & acquisition guidelines, expected in a couple of months, could facilitate consolidation. About three to four fewer operators in the market would thus help sustain the pricing stability.

Call rates in India hit rock bottom amid intense competition since late 2008, denting companies' financials.

However, the Supreme Court's decision to cancel over 122 telecom licences early last year came as a blessing for unaffected operators, mainly the bigger ones with licences to offer services across the country, as competition eased.

Players such as Bharti Airtel, Idea Cellular and Reliance Communications raised call rates - by an average about 4% in the April-June quarter - which helped grow their revenue per minute (RPM) and average revenue per user (ARPU), said analysts. The companies added that there was room to further raise rates, but didn't say by how much. Despite the increases, call tariffs in India are still among the lowest in the world at about 60-70 paise a minute, which could go up to 70-80 paise if the executive's wish is accepted. "As we go forward, you will see some more hardening in the coming months," Gurdeep Singh, president & chief executive (wireless business) at Reliance Communications, told ET recently.

The industry "needs and can afford" to raise call tariffs by 6-10 paise, brokerage Kotak said in a report. "We also believe that this would happen in a few steps and may not be a sustained gradual increase; it would of course be a calibrated one over the next 1-2 years."

Still, while all operators are convinced about the need for an increase, the quantum is still up for debate. Sigve Brekke, head of Norwegian telecom major Telenor ASA's Asian operations, said a 10-paise "hike is good but only for big operators".

"Our target customers cannot afford such a hike, and we feel there is still a lot of growth left in this country which can be targeted through the classic low-tariff, high-volume model," he said. Uninor, Telenor's India unit, offers services in six of India's 22 service areas.

Analysts say that while Uninor needs to add subscribers aggressively, and hence can't afford to raise rates too much, the bigger players have already attained strong mobile penetration.

The big operators do have a case, they add.

An analyst at a Mumbai-based foreign brokerage said each 1 paisa increase in call rates translates into a 6.5-10% growth in net profit, depending on the size of the operator. "The smaller the operator, bigger the benefit." He added that Bharti Airtel would be towards the lower end of the range as its consolidated net profit includes its stressed Africa operations, while Idea and Reliance Communications would benefit more.

No comments:

Post a Comment